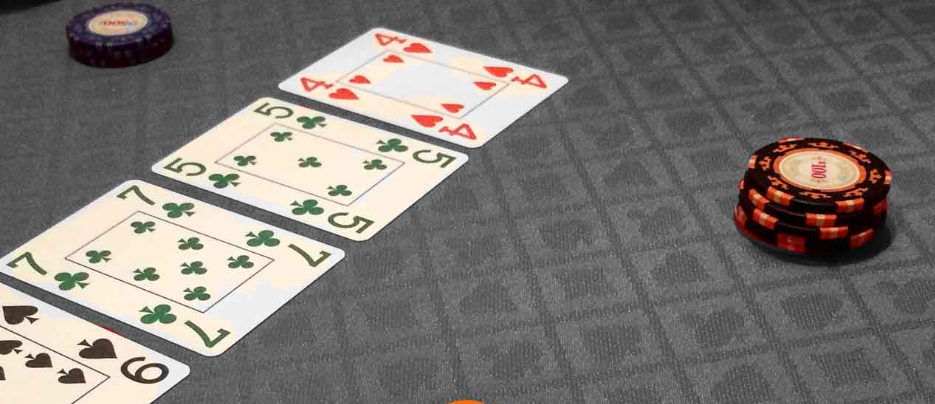

I made the unfortunate mistake of comparing what some friends do as day traders to what professional gamblers do.

And I drew this comparison without any malice.

Nevertheless, my stock-trading friends were offended. It struck me as odd, because the similarities are obvious. Understanding these similarities will likely help you succeed in daytrading. I want to point out a clear difference between trading and investing. Investing is a long-term tool to secure future financial security.

Trading is used to create short-term cash flow.

If you can understand the business of gambling, it will help you better understand the business of daytrading.

Here’s how exactly day trading is similar to gambling.

Odds and probabilities

The first thing to understand is that we are constantly dealing with odds and probabilities. No matter what the market conditions are, you can find favorable situations on things like currency exchanges. You can also take advantage of developing markets with huge growth potential to acquire stronger commodities.

In the case of a weak commodity market, the odds are likely to be in your favor. But you’re not guaranteed a huge return, despite market imbalances. Have you ever stepped onto a casino floor and exchanged your cash for chips at one of the tables? If so, you’re familiar with the idea of putting your money on the line to cover travel or lodging expenses.

Of course, that giant monument to overindulgence known as Las Vegas wasn’t built on the backs of winners. No, casinos understand something that many blind tourists overlook. Casinos make sure that the odds are tilted in their favor.

If you want to transform yourself from a money-losing trader to a profitable trader, you need to learn how to tilt the odds in your favor.

Tilting the odds in your favor

If you polled 10 people walking down the street and asked them if gambling was a profitable business, you would get two answers, of course:

But you might be surprised at how many answers were in the affirmative. There would also be a “no” or “2” – no doubt. And this is probably true for these people. They may never gamble or never have really thought much about the gambling business. Then you’ll have the “yes” crowd. Unfortunately, many of them will be foaming at the mouth, imagining their millions.

Of course, they just need that inside trick or tip at the big event. Maybe they just need the right system to come along, or they need to improve their card counting skills. Regardless, after a long time, those “yeses” would turn into “noes.”

Be Home

Casinos operate according to one rule: don’t offer a game if the odds are not in the casino’s favor.

The same rule applies to successful day-traders. You must take those trades that offer the best chance of profit. Casinos build value by strictly defining a minimum and maximum bet amount. Without them, some gamblers’ values would be too low. The juice wouldn’t be worth the squeeze.

However, if a whale shows up and drops $1.5 million on one side and the outcome is favorable, it could result in a poor week for the sports casino – perhaps even wiping out all other profits. Therefore, to limit the possible havoc, casinos usually look to limit the size of bets.

For day-traders, you should never bet too much on any particular trade, no matter how confident you are. Unfortunately, there is always the risk that a trade will go against you.

To be successful, you need to mitigate this risk.

If you have spent a lot of time gambling, you are familiar with money management. For day-traders, this is a basic safeguard of capital. Your long-term goal should be to take advantage of these favorable risk/reward opportunities. You shouldn’t bet everything on one transaction – just as a gambler shouldn’t walk into a casino with his entire $20,000 bankroll, sit down at the roulette wheel and bet on 1-12. Sure, you can win 2 to 1, but you risk going broke.

The average day trader vs. the average casino boss

So how do the average daytrader and the average casino boss overlap? We already know that casinos only play where they have an advantage. Successful day traders also know to focus on fewer trades where they find more potential. Casinos have a discipline similar to Buddhist monks to minimize risk through table limits.

A disciplined daytrader maintains a Buddhist monk-like discipline in protecting his capital to capitalize on his advantage.

The casino places a clear emphasis on overall profitability by keeping butts in seats 24/7. Day traders in the black understand that each individual transaction is only one of thousands in building a successful and sustainable income.

Conclusion

Is day trading a gamble?

Not really.

However, they are similar in many ways. If you randomly move money between markets on equal probability trades or loose trading, you are likely to give money away. This reminds me of the millions of casino gamblers who make the annual pilgrimage to the desert and randomly place uninformed bets.

Even most casino gamblers are only 8% off at worst. So how can so many of them lose their entire bankroll in a relatively short period of time? It is because they use poor risk management and continue to throw good money after bad.

I suggest that every daytrader take a cue from the casino owner’s playbook and start improving their profits.

0 Comments